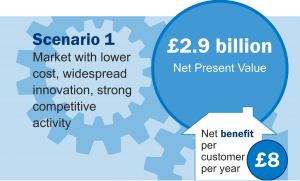

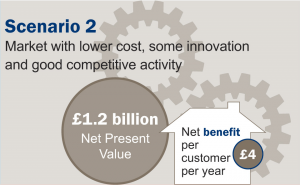

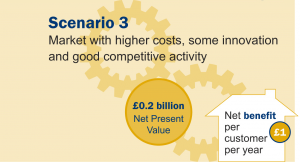

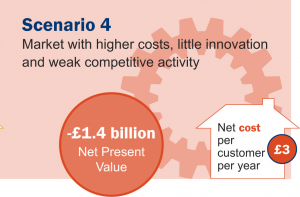

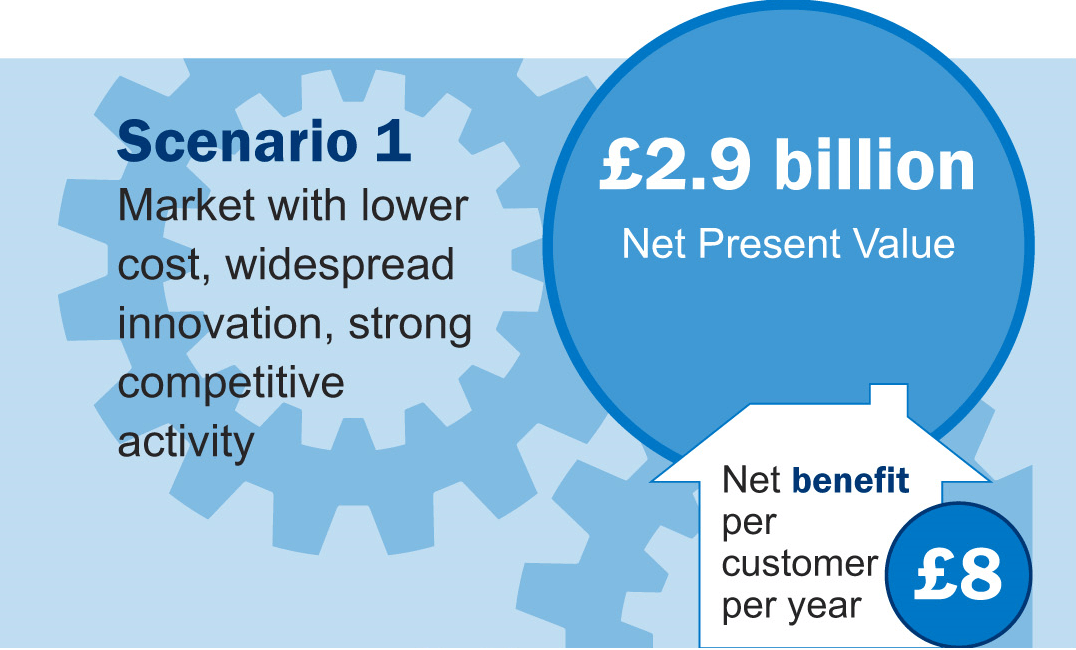

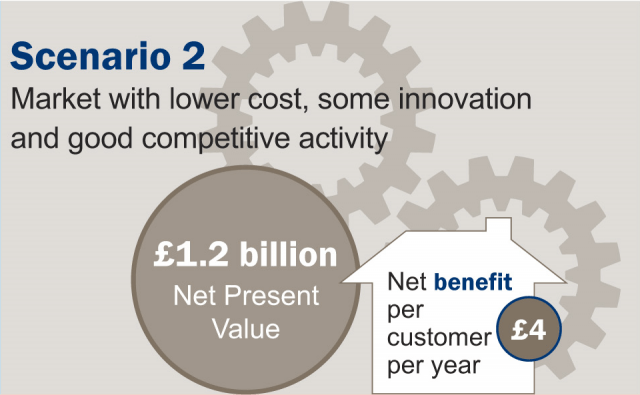

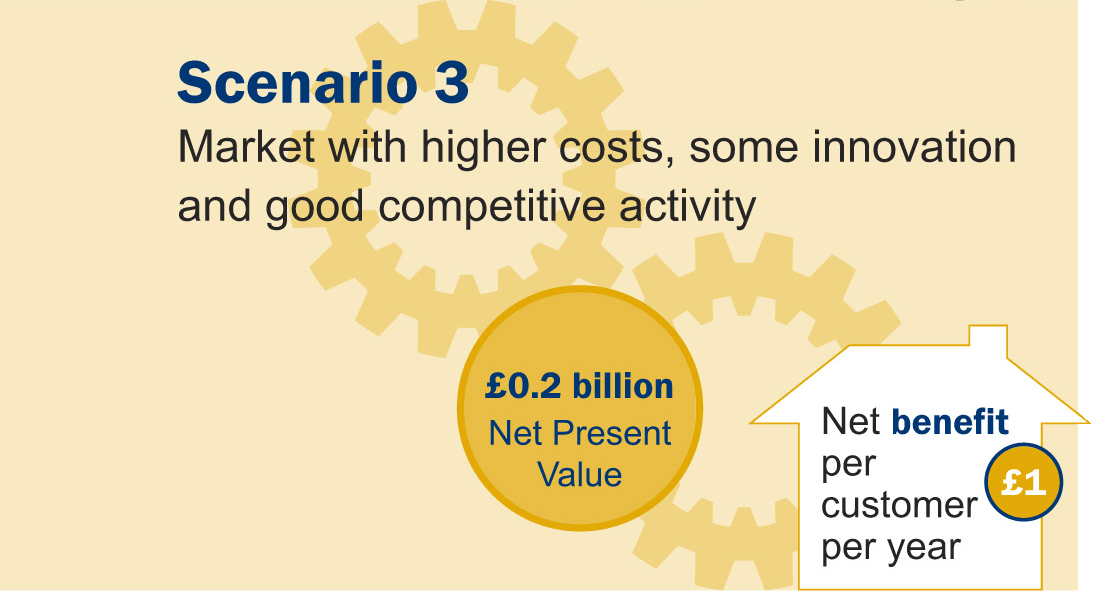

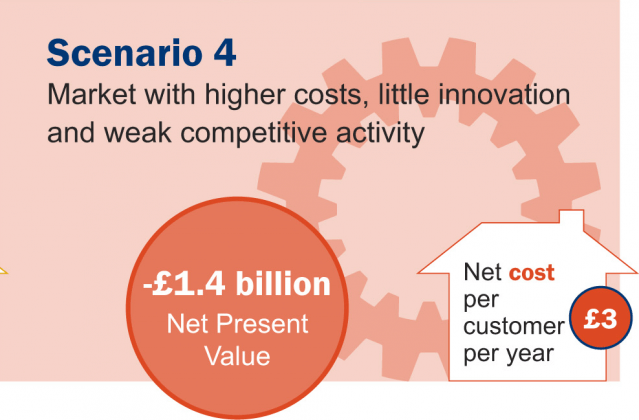

To inform our assessment, we modelled the potential costs and benefits of competition in four illustrative scenarios over a 30 year period – this helps us to calculate the ‘Net Present Value’ of introducing competition.

There are some costs and benefits which we can put a financial value on and others which we cannot. Both are important in making an assessment about the value of opening the market to competition.

Assessing the unquantifiable elements

Potential unquantifiable costs

- Potentially invasive and undesirable sales practices

- Different experiences for customers taking part in the market and those not taking part

Potential unquantifiable benefits

- Freedom for customers to choose and the power to walk away when service falls short or a better deal is found

- Makes customers’ lives easier with new services, offers and bundles of products

- Better customer service and innovation

- Greater water resilience and less pressure on scarce water resources

Tackling the unquantifiable costs

Both of the unquantifiable costs could serve to undermine trust in the market.

It is essential, therefore, that the market is designed to help customers in any circumstances of risk to be treated as fairly as possible. This includes ensuring all customers are able to access relevant support to inform strong decision-making.

Assessing the quantifiable elements

The quantifiable elements affecting our assessment are broken down for each scenario in the information below - simply click onto each scenario tile to see the detailed breakdown.

Quantifiable costs

- £7.00 a year per customer on time spent looking for the best deal

- £367 million overall cost of setting up the new retail market

- £8.30 cost to retail companies for each customer successfully won

- £4.2 million overall cost to regulators in adapting to the new market conditions and requirements

Quantifiable benefits

- £2.9 billion in financial savings – equivalent to £8 per customer per year

- £183 million from improvements in customers’ energy efficiency

- £199 million value in reduced carbon footprint

- £389 million from improvements in water efficiency

- £856 million through better debt management

- £2.5 billion in savings from more efficient retail and wholesale operations

- £55 million in savings from less rainwater run-off, more wastewater recycling leading to greater drainage capacity and protection from flooding

Quantifiable costs

- £10.50 a year per customer on time spent looking for the best deal

- £389 million overall cost of setting up the new retail market

- £15 cost to retail companies for each customer successfully won

- £5.6 million overall cost to regulators in adapting to the new market conditions and requirements

Quantifiable benefits

- £1.2 billion in financial savings – equivalent to £4 per customer per year

- £46 million from improvements in customers’ energy efficiency

- £52 million value in reduced carbon footprint

- £98 million from improvements in water efficiency

- £455 million through better debt management

- £1.9 billion in savings from more efficient retail and wholesale operations

- £26 million in savings from less rainwater run-off, more wastewater recycling leading to greater drainage capacity and protection from flooding

Quantifiable costs

- £10.50 a year per customer on time spent looking for the best deal

- £733 million overall cost of setting up the new retail market

- £40 cost to retail companies for each customer successfully won

- £7 million overall cost to regulators in adapting to the new market conditions and requirements

Quantifiable benefits

- £185 million in financial savings – equivalent to £1 per customer per year

- £46 million from improvements in customers’ energy efficiency

- £52 million value in reduced carbon footprint

- £98 million from improvements in water efficiency

- £455 million through better debt management

- £1.9 billion in savings from more efficient retail and wholesale operations

- £26 million in savings from less rainwater run-off, more wastewater recycling leading to greater drainage capacity and protection from flooding

Quantifiable costs

- £21 a year per customer on time spent looking for the best deal

- £746 million overall cost of setting up the new retail market

- £40 cost to retail companies for each customer successfully won

- £7 million overall cost to regulators in adapting to the new market conditions and requirements

Quantifiable benefits

- £1.4 billion in financial costs – equivalent cost to each customer of £3 per year

- Zero financial value in improvements in customers’ energy efficiency (or no noticeable energy efficiency improvements)

- Zero financial value in reduced carbon footprint (or no noticeable reductions)

- Zero financial value from improvements in water efficiency (or no noticeable water efficiency improvements)

- Zero financial value through better debt management (or no progress made in tackling debts)

- £0.9 billion in savings from more efficient retail and wholesale operations

- Zero financial value from less rainwater run-off, more wastewater recycling leading to greater drainage capacity and protection from flooding