We all rely on water every day and we know how important it is for people being able to live healthy, fulfilled lives. There is more focus on the water industry than ever before, including on the level of investment and the outcomes it delivers for customers.

Investment is spending by companies on new reservoirs, treatment plants and pipes which help contribute to the delivery of services now and in the future. Investment itself isn’t an outcome, it is the services delivered by the investment that matters but it can be a useful indicator of how companies are preparing to deliver services for future customers.

It’s worth exploring some of the questions about investment in the industry.

- I’ve heard that investment in the water and wastewater sectors has steadily decreased over time. How have you allowed this to happen?

- Is the water sector is underfunded?

- Why does Ofwat sometimes reduce the amount of money companies want to invest?

- Why doesn’t Ofwat give companies enough money to invest?

- Why hasn’t the environment been a bigger focus for Ofwat?

- Why do companies pay dividends when they could be investing that money in better customer outcomes?

- There are so many areas of water quality that could be improved. What has investment achieved?

I’ve heard that investment in the water and wastewater sectors has steadily decreased over time. How have you allowed this to happen?

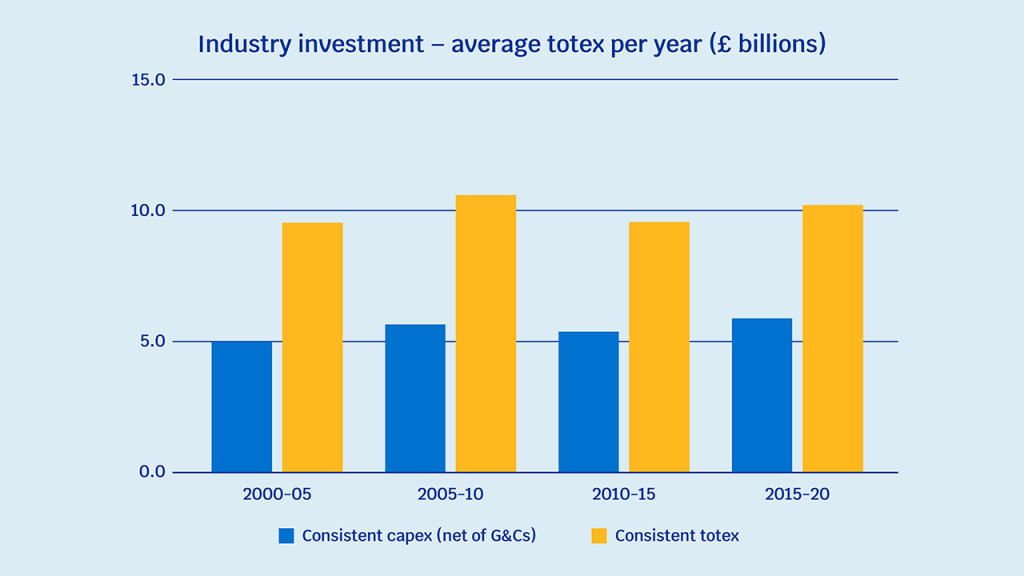

Investment in the industry has roughly doubled since privatisation in 1989, rising drastically in the 1990s. Average totex (total expenditure) has been consistently running at around £10bn a year since 2000, and average capex (capital expenditure – money spent on assets, such as such as buildings, equipment, and technology) has been between £5bn and £6bn a year, reaching the highest point in that range (£6bn) between 2015-2020.

While capex is the more traditional measure of investment, some modern types of investment (such as investment in sustainable and environmentally friendly solutions) may involve less capital expenditure and more operating costs (which are covered in totex figures). This is why we have moved towards a focus on that total investment, rather than a crude focus on one kind of expenditure. So, the nature and focus of investment has changed, not the level of investment.

Is the water sector is underfunded?

Companies are well funded and could invest more if they wanted to. For example, in the 2015-2020 period, water and sewerage companies actually underspent by 5% our price review allowances for investment in their wastewater facilities.

We made sure that there was enough funding to cover all the improvements set out in the English Water Industry National Environmental Programme (WINEP) and the Welsh Environment Programme (NEP), and in our last price review we allowed companies £4.8 billion to deliver these environmental improvements. Companies are responsible for proposing the level of investment as part of their business plans submitted to Ofwat every five years.

Why does Ofwat sometimes reduce the amount of money companies want to invest?

Ofwat encourages investment that will deliver value for customers and the environment. When companies submit their investment plans to us, we challenge them, but that challenge is to deliver their improvements as efficiently as possible, helping customers’ money to work harder and go further.

For example, a company may tell us they can deliver a new nature-based solution that will help improve water quality and that it will cost £10m. We benchmark this against what we consider to be a fair price, based on the knowledge we have from overseeing the whole industry. Using that insight, we might then go back to the company and tell them we think they can deliver it for £9m. This approach ensures investment delivers the same improvements, but for an efficient price.

Why doesn’t Ofwat give companies enough money to invest?

Ofwat doesn’t give companies any money to invest! We try to ensure the water and sewerage companies invest money efficiently, but ultimately the money that is being invested is from customers. Customers pay their bills, and the water company uses that money for a variety of things – including investing for the future. This is why it’s so important to ensure customers are getting good value for money on investment and we take our role seriously in making sure that money is spent efficiently.

Why hasn’t the environment been a bigger focus for Ofwat?

We’ve always allowed investment in the environment, and we care about this as much as customers do. In our 1994 price review we allowed £12bn of investment (in today’s prices) over the following ten years towards better sewerage treatment to improve coastal and estuarial waters.

We have allowed an average of around £1bn every year to be spent on improving the environment since privatisation.

We care about the environmental impact of companies – including on river quality and storm overflows. That is why we are pleased the Environment Act 2021 will introduce new obligations on English water companies to provide more transparency about river quality and overflows, and progressively reduce the harm from storm overflow discharges.

We’re working very closely with colleagues at the Environment Agency and other relevant bodies to ensure that protecting the environment is as much a focus for water companies as it is for us.

Why do companies pay dividends when they could be investing that money in better customer outcomes?

Ultimately, customers pay for investment in the industry, but they pay for this over a long period of time. Companies must pay for new investment upfront, so they need to secure a large funding to pay for this. To avoid customers’ bills increasing drastically to pay for this, companies can secure the money by raising debt or equity (shares in the company) to investors.

If a company takes on new debt, they pay interest on that capital. If a company raises equity, they will pay dividends to the equity holders that reflect business performance of the company. These two costs (interest payments or dividend payments), are the cost of the capital the companies raise. If a company did not pay dividends, it would struggle to get access to finance to fund investment and this would limit the level of investment and impact on service for future customers.

There are so many areas of water quality that could be improved. What has investment achieved?

Investment in the industry has roughly doubled since privatisation in 1989, rising drastically in the 1990s. This has led to some major achievements in the last 30 years, which are even more stark when comparing today’s situation to the situation pre-privatisation.

Prior to privatisation the industry was competing for investment with everything else a government could spend money on; education, health, welfare. This meant that investment was constrained and so water quality was relatively poor, beaches had real issues with sewage and leakage was a significant issue.

The industry is in a much better position now. In the 1990s beaches were cleaned and a great number are now considered to be in excellent condition, in the 2000s we saw big improvements on internal sewer flooding, and our focus on leakage is starting to pay off with big reductions.

Long-term data series of company costs

This Long-term data series of company costs spreadsheet sets out water company capital and operating costs over time.

![[Graphic with text: Fact: Customers pay for industry investment over the long term]](https://www.ofwat.gov.uk/wp-content/uploads/2022/03/Investment-TwitLIn6-NL-1024x576.jpg)