During the Listen Care Conversation, we shared stories and research, which dived deeper into the key issues.

Listen Care Share report

In July 2021, we published our report Listen Care Share: Water customers’ experiences during Covid-19, (Cymraeg) which outlines what we heard during the Listen Care Share conversation, alongside research we commissioned in March 2021. It also highlights the challenges faced by water customers and suggests areas for water companies to consider changing their approach.

We are asking water companies to familiarise themselves with the findings in our report and consider the areas of change we have identified. We want companies to provide the best possible support to customers both now and in the future. Within Ofwat, we are carefully thinking about how the report findings should influence our own work.

Read more about the stories we heard during the Listen Care Share conversation.

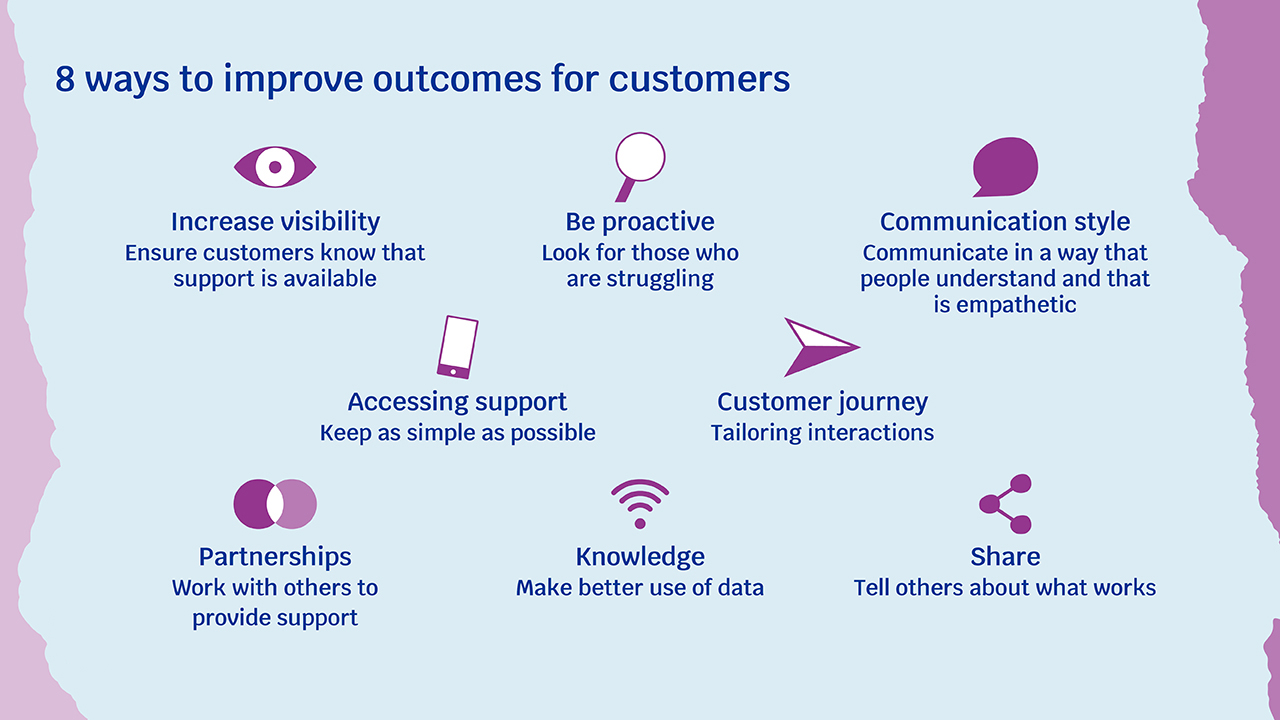

PN 20/21: Ofwat outlines eight ways water companies can provide support to customers

Supporting documents

Jump to the key themes of the conversation:

Financial vulnerability

The pandemic has hit many customers hard. There can be no doubt that the financial impact continues to bite so we’ve delved beneath the surface to find out what this means and how it feels for customers.

As part of our Listen Care Share conversation, we carried out research in late March on the impact of the pandemic on water customers. We commissioned Panelbase to conduct an online survey of 2,100 bill payers in England and Wales. ICM conducted qualitative research for us – using a three day online panel of 15 participants, with follow up telephone interviews.

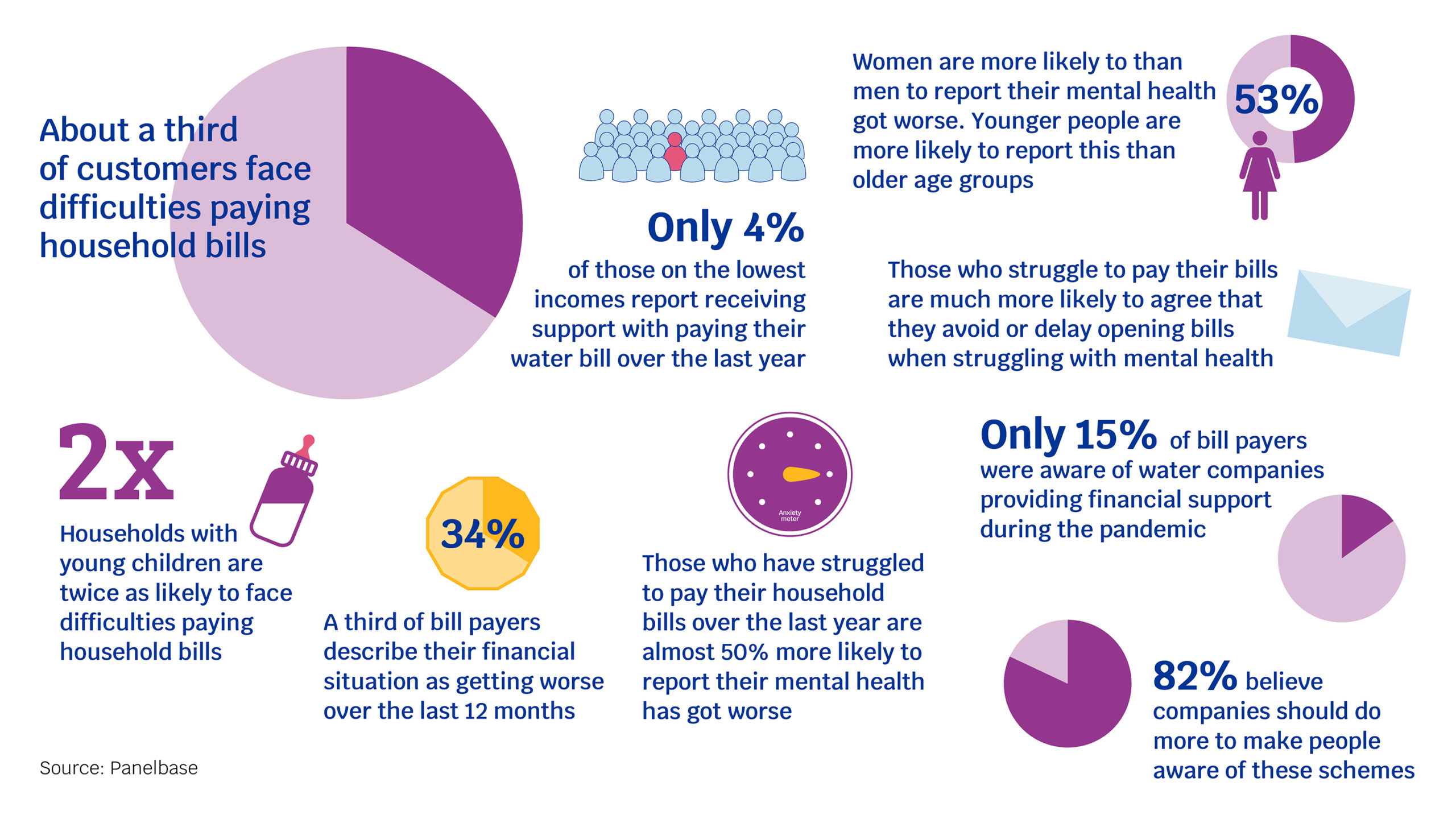

Key highlights from our research found some customers are:

- Facing extremely challenging situations, with a third of customers struggling to pay household bills. Four in ten customers are worried about money over the next six months. This rises to 54% of those on the lowest incomes. Only a tiny proportion (3%) of customers report receiving financial support from their water provider over the last year.

- Making difficult decisions when it comes to paying bills, being three times as likely to pay bills by credit card than ask for support from their company.

- Keen to find out more about available support – only 15% were aware of water companies providing financial support during the pandemic. However, when told about it, customersare surprised and pleased to learn that financial support from water companies (and utilities more generally) is available.

‘Natalie’ is a working mum whose working hours change frequently. Find out more about her story.

Our research highlights the very real challenges facing customers.

Some of these customers are newly vulnerable and facing the hurdle of accessing support for the first time. We also heard that some of these customers do not know how to approach people for help or where to look for support.

While debt and collections leaders in UK utilities report that the amount of debt sitting on utilities books is not sky rocketing, participants in Utility Week research ‘are continuing to brace themselves for a wave of debt…’.

The Office for Budget Responsibility has predicted that unemployment will peak at 6.5% in Q4 2021, if these predictions play out, more customers may become financial vulnerable by the end of the year.

Our research shows customers who need support don’t always know what help is available to them. More needs to be done to anticipate customers’ needs and reach those struggling to pay and their support networks. Easing the financial burden for customers who are struggling could make a huge difference at the time when they might just need it most.

You can join the Listen Care Share conversation on social media, using #ListenCareShare, or email [email protected]

PN 16/21: Mae cwsmeriaid dair gwaith yn fwy tebygol o dalu biliau â cherdyn credyd na gofyn am help

Mental wellbeing

There can be no doubt the pandemic has taken a toll on our mental wellbeing and we wanted to better understand what this means for customers. Our research commissioned in March 2021 found around half (48%) of bill payers report their mental health has been worse over the last year.

We have found a vicious circle has been worsened by the pandemic. Customers in need of financial support are more likely to have poor mental health, but those who struggle with their mental health find it much harder to ask for help with bills.

Our research, carried out as part of our Listen Care Share conversation, showed:

- While around half of bill payers report their mental health has worsened over the last year, this rises to six in ten (58%) of those who find it hard to cover their bills.

- Half of bill payers (51%) believe that struggling with mental health makes it harder to ask for help with bills and some are not aware that support exists. For those already facing challenges with their bills, that rises to two-thirds (65%).

- 4 in 10 (41%) of those who find it hard to pay bills avoid or delay opening bills when struggling with their mental health.

Some parts of the population have been affected more than others.

- Women are more likely to report worse mental health than men (53% compared to 43% respectively).

- Younger people aged 18-34 are more likely to report worse mental health than those aged 55+ (55% compared to 43% respectively).

Further research from the Office of National Statistics (ONS) confirms . Their research also shows that those with disabilities or who are clinically extremely vulnerable have had worse mental health over the last year.

Mental health experts are concerned that the mental health impacts will not quickly disappear with the easing of lockdown.

The link between mental health, ability to pay and low awareness of support has become a growing concern. However, our research also suggests that when customers receive support, it can have a positive impact on their wellbeing.

David Black, Interim Chief Executive at Ofwat said:

“Customers who are struggling financially and have poor mental health are less inclined to seek help. Breaking this vicious circle is a difficult challenge to overcome, but one that can be tackled by companies working better with their customers.

“Companies can go even further to promote the services they have available to instill trust in bill payers so that issues can be identified at an earlier stage.

Do you have thoughts on what we have found, or examples of best practice examples of mental health support for customers during the pandemic? You can join the Listen Care Share conversation on social media, using #ListenCareShare, or email [email protected]

Information inequality

What came out loud and clear from our Listen Care Share research is that information about the types of customer support available is not reaching those who need it. Only 15% of customers are aware that financial support for those who need it most has been available from water companies during the pandemic. Two-thirds do not know about the Priority Services Register (PSR), which aims to ensure special assistance is provided to customers who need it. This finding is especially worrying as the PSR is a service that can provide a lifeline to customers, particularly for those in vulnerable circumstances.

Why is information not reaching customers? We found a complex combination of issues, including differing levels of literacy and digital skills amongst customers, as well as some feeling embarrassed to ask for help., There can also be some organisational blind spots to certain types of vulnerability.

Skills gaps

We heard about some very real challenges that some customers face every day. These include low literacy rates, language barriers and difficulty in filling in forms.

We asked those who had applied for support with water about their experiences. Of the small percentage of bill payers who have been through the process, 57% felt it was difficult to fill in the forms or provide the information requested by their water company.

We also heard that digital exclusion continues to be a problem, especially as a lot of information moved online during the pandemic. Ofcom found that only 6% of homes were without internet access in March this year compared with 11% in March 2020.

Information inequality and organisational blindspots

We heard that those in vulnerable circumstances may face particular challenges when it comes to communications. Certain health conditions or medications can affect people’s concentration, decision-making capabilities or their ability to use certain communication channels. This needs to be accounted for when communicating with customers.

The disability charity, Scope and consumer complaints website, Resolver Group both told us that organisational blind spots around different types of vulnerability can lead to exclusion by accident. Scope highlighted how organisations can have blind spots to certain types of vulnerability, for example bereavement care, mental health or physical disabilities.

Embarrassment

Customers experiencing financial problems for the first time may be extremely reluctant to share that they’re in need of support: “There will be a real pride issue there,” said one customer experience professional taking part in an event run by industry magazine, Utility Week.

Research by the Financial Conduct Authority (FCA) found that over-indebted adults report that one of the biggest barriers to accessing support services is embarrassment discussing their debts or not wanting to face dealing with the problem (35% gave this reason for not using debt advice).

The process for seeking support can also be daunting: “Before last year I never had to look into any of this. It all felt really daunting.” (ICM Qualitative research, Female, No Support)

We’re keen to make sure water companies are fully aware of the different types of vulnerability that exist. This is so they can provide the right support to the right customers, in a way that’s easy for customers to access and understand. Through an open and collaborative approach with water companies, we can help make sure that all customers are importantly getting what they need from their water company, with their skills and needs supported.