Overall service incentive mechanism scores 2016-17

The average SIM score across the sector rose from 82.5 out of 100 in 2015-16 to 83.7 in 2016-17. Portsmouth Water topped the table again this year, albeit with a lower score than its 90 achieved last time. Wessex Water is once again the highest performing water and sewerage company, narrowly finishing above Northumbrian which climbed five places from 8th last year. Thames Water is bottom of the table this year, replacing Southern Water. The three companies in the bottom three this year are the same three as last year (albeit in a different order).

We are pleased to see an increase in companies’ average SIM score as this suggests that the industry as a whole is improving its customer service although we are disappointed to an increase in the number of unwanted contacts. We want to see companies doing better as we know that customers’ expectations are constantly rising, and that they expect the same levels of customer service they receive elsewhere.

| Company | Overall SIM score |

|---|---|

| Portsmouth | 87.7 |

| Wessex | 87.5 |

| Northumbrian | 87.5 |

| Bournemouth | 86.5 |

| Dee Valley | 86.0 |

| Bristol | 85.9 |

| Anglian | 85.6 |

| United Utilities | 85.4 |

| South East | 84.6 |

| South Staffs Cambridge | 84.4 |

| Severn Trent | 83.6 |

| Yorkshire | 83.4 |

| Welsh Water | 82.9 |

| South West | 81.6 |

| SES | 79.6 |

| Affinity | 78.6 |

| Southern | 78.1 |

| Thames | 77.3 |

| Average | 83.7 |

Customer satisfaction 2016-17 results

The annual SIM survey report shows the results of four customer satisfaction surveys conducted across 2016-17. The survey asks customers how satisfied they are with their water company’s handling of queries and resolving issues. We use an independent company to conduct the customer surveys.

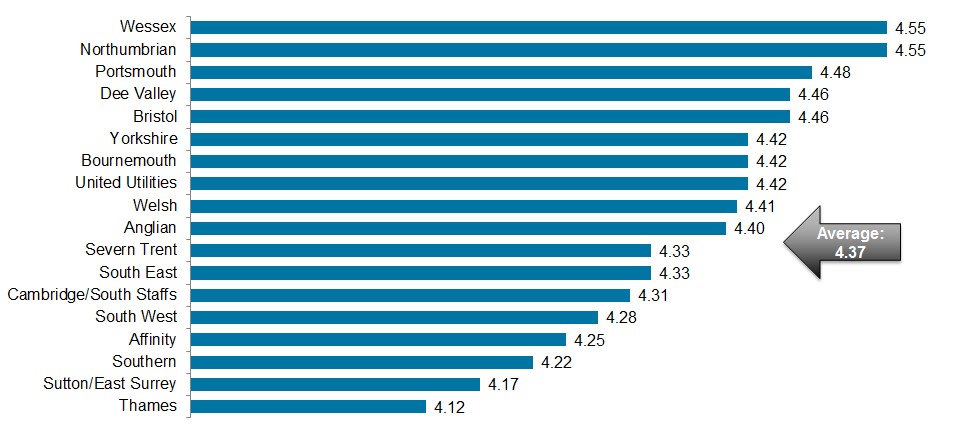

These results show a positive trend, with average customer satisfaction rising to 4.37 out of 5, up from 4.33 last year.

Overall, customers of Wessex Water said they were most satisfied, with Northumbrian Water’s customers a very close second. Thames Water’s customers were least satisfied.

- SIM survey satisfaction results have improved significantly since 2015-16 and this is largely driven by the significant increases in the mean satisfaction scores for clean water and wastewater queries. However, the SIM scores for billing queries still remain significantly higher than clean water or wastewater.

- Although online customer contact represented only a small proportion (one in 25) of customer queries, the SIM scores (i.e. degree of satisfaction) for online contacts were significantly higher than for contacts via other channels. Telephone was by far the most common means of customer contact and the SIM score for this communication channel was the second highest.

- Four in five customers considered the matter they contacted their company about to be resolved. This figure is significantly higher for billing queries than clean water or wastewater. Those who considered the matter to be resolved were significantly more likely to be satisfied than those who considered the matter to be unresolved.

Download the full report on the 2016-17 service incentive mechanism survey results.

Numbers of complaints 2016-17

Companies report the number of complaints they receive to the Consumer Council for Water.

Download ‘Complaints to Water Companies England and Wales April 2016 – March 2017’ from the Consumer Council for Water’s website.

The report shows that some companies are doing better than others at reducing the number of complaints they receive. Whilst the number of written complaints has fallen since last year, the number of unwanted contacts has risen and now stands at 2.2 million. We expect good customer service from all companies, in reducing complaints and increasing customer satisfaction, and so the SIM rewards companies who provide good customer service, and penalises those that do not.

We are proposing that the Customer Measure of Experience (C-MeX) will replace the SIM as the incentive for companies to improve the experience of residential customers from 1 April 2020 onwards. Our consultation on C-MeX is contained on pages 82-85 of our PR19 methodology consultation.